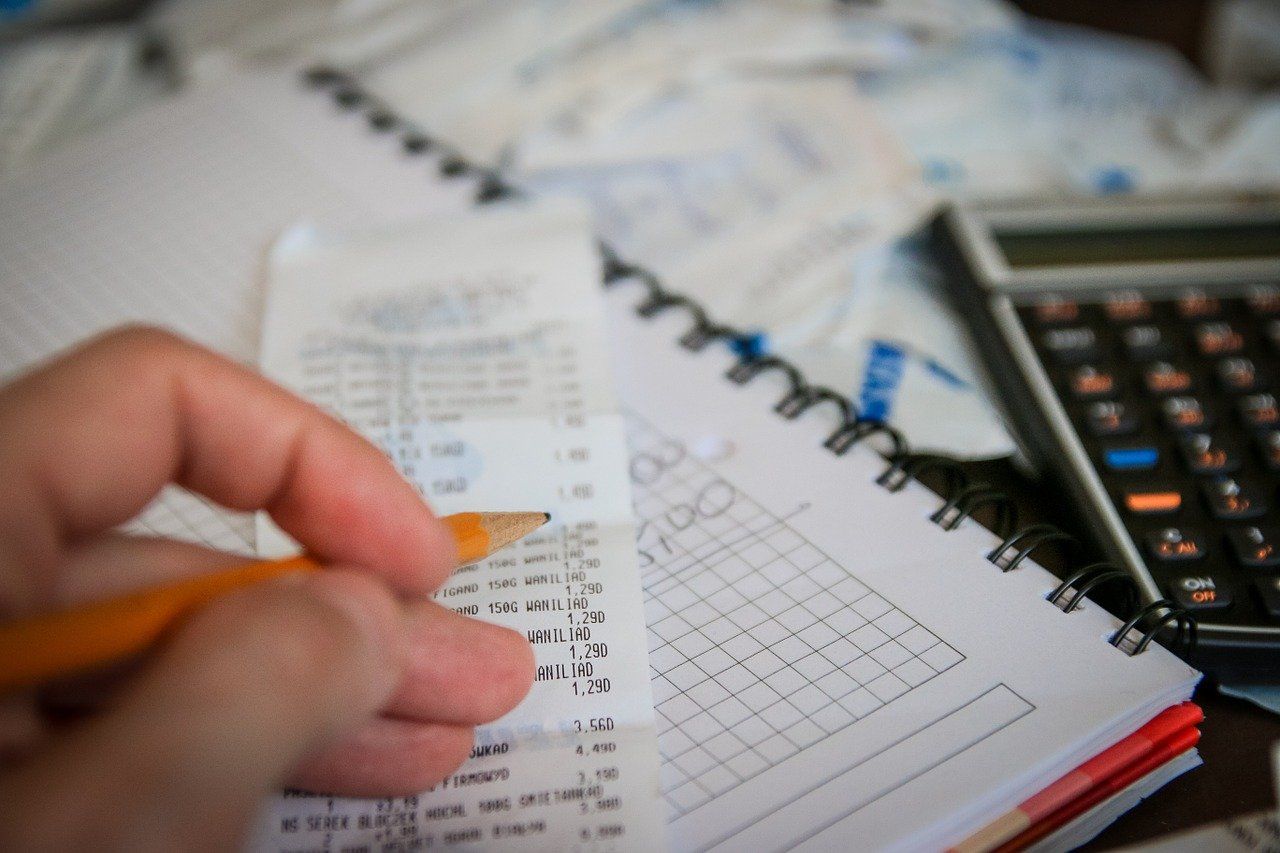

The first advice you receive from a financial expert is to save. As the often quoted saying of a money adviser would say, do not save what is left after spending, but spend what is left after saving. That is how important saving is in your life. If an ant stores food for the rainy days to remain alive then so should humans do in order to survive. Several studies have already mentioned the poor saving habits of Filipinos. One of the reasons is the income is barely enough to tide them through the day or month. That may be the case for some, but it does pay to listen and take heed of what financial experts may say.

The importance of saving cannot be underestimated. It allows you to enjoy greater security in your life or to put it simply, having money makes your life easier. To know the reasons why you have to save money is important if you want to make it a long-term plan. After all, it takes a lot of discipline and sacrifice to succeed at it.

Even if many strategies can help us succeed in saving, these plans may fail if you have the wrong mental attitude. Here are some common money-saving myths that you have to breakdown first.

Myth №1: Sale items are good buys.

Many businesses always have a purpose for holding sales. They want to make money during these events, want you to try their product or get rid of extra stuff, or just want to make their business look good. These sales are always heavily advertised so you can succumb to them and end up parting with your hard-earned money.

Buy what you need first and postpone buying your wants for a few weeks. Later on, ask yourself if you really want those items. If yes, buy those items only if you have extra money but never use cash intended for your necessities. It is important to know how to distinguish which purchases are needs or wants. That way, you will not be wasting your resources unnecessarily. After all, the sale was really made for the businessperson.

Myth №2: The best way to save is by depositing money in the bank.

Financial experts always say that you save first before you spend. This sometimes comes as a big turnoff for many because you seem to remove the words “fun” and “rewards” from working hard. It is best to follow the 50-20-30 budget rule for beginners. This is 50% for your needs, 20% for savings, and 30% is for wants. You can use this method until you develop a tailor-made spending rule for you. The advantage of using this form of budgeting your income is to keep you from spending recklessly, as you need to put aside some money while having some fun along the way.

Myth №3: To save is to compromise

Some people think that saving a portion of their salary every month entails a lot of sacrifices, even foregoing the small pleasures of life. Some equate it as hardships and the result will not be known until later on which may not be to your liking. A wealth adviser believes that taking away a lifestyle today for a better one in the future is worth it. The money you saved today will surely lessen the standard of your lifestyle at this time, but by doing so assures you a better life in the future. It is best to be poor now and rich in the future.

Myth №4: Save before paying debts.

Prioritize paying off your debts. Having enormous savings in your bank account is good but if you have huge outstanding debts, you will end up losing a large amount of money as the accumulating interests from your loan is bigger compared to the negligible interest rate you get from your savings account.

Settle all your debts. Some financial advisers suggest putting away money for your emergency fund, even if a small amount. But as a general rule, if you can do both then good for you. Remember, just give a higher precedence to debt payment.

Having the right fundamental skills about saving money is important. As the Philippines is emerging to be more economically competitive, opportunities abound for Filipinos to become more financially secure. It is time to get rid of the old myths about savings and be prepared to go for a better future.

Myth №5: All loans are bad for you

It’s perfectly normal to apply for a loan at a difficult time in your life. Millions of people do it, use the money for good and pay it back successfully. If you need extra money to start a business, pay off debts or pay for emergency expenses, visit Robocash website. It can provide you with microloans provided you meet the requirements and can show a valid government ID and a working phone number. Just remember that you should only take out a loan when you really need it.